secu car loan credit score

While theres no universal. We have low fixed.

Only Ca And Nh And Hawaii Don T Use Credit Scores To Assess Auto Ins Premiums Fact Good Credit Dui Bett Bad Credit Score Loans For Poor Credit Car Loans

For most lenders anything above 700 is considered good to very good and should help to qualify you for a mortgage or car loan.

. FICO also provides credit scoring models that are specific to the auto industry giving lenders more specific information on your likelihood of paying back a. While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to get approved for a loan and the loan terms. CSE Credit Union offers highly competitive rates on all of our auto loans.

We offer new and used products with a variety of terms to fit all of your needs. Up to 070 off of your loan rate. Schlumberger Employees Credit Union offers convenient auto loan financing to members residing in the US.

FICO Auto Scores. Learn about our Rate Beat and Loan Experience Guarantee Now. The woman I spoke with says they - 5295064.

Account setup was relatively. Apply online through our mobile or desktop. Rates are competitive and the application.

The auto loan rates above reflect the discount for a direct loan payment option from a SECU account. SECU is unable to spell business - much less provide banking services for one. Auto Loans for New and Used Vehicles.

New financing rates and terms for vehicles up to two years old. Has anyone out there gotten an auto loan through the State Employees Credit Union in NC or another state. In a Nutshell.

Ad Read Expert Reviews Compare Your Car Financing Options. Used financing rates and terms for older vehicles. As a member of the Credit Union you are eligible for the SECU Fast Auto Loan service.

Boeing Employees Credit Union now known as BECU auto loans offer members the potential for a rate decrease on qualifying loans if their credit scores. May 5 2021 shawanvalleybirding. SECU strives to make the process of obtaining an auto loan as easy as possible.

Cash-out refinances are limited to 100 of the vehicle NADA retail value. As a member of the Credit Union you are eligible for the SECU Fast Auto Loan service. Receive online certificate or check within 24 hours and use your check to buy the car you want or use it to refinance your current loan.

Refinance Your Current Auto Loan with SECU and Save Big. Enjoy extra savings with our Membership Benefits. We offer fixed rate financing for used vehicles with terms up to 72 months.

Decisions made here in New Mexico. Friendly and convenient service. Ad 10000 Cars Trucks SUVs - Priced from 8k to 30k - 2 Minute Online Approval.

Free Vehicle History Reports - 5 Day Return - Limited 30 Day Warranty - Worry Free. 2 off for up to 48-months 15 off for 49-60 months 1 off for 61. All the perks of financing your auto loan with SECU.

For any second-hand vehicle. The SECU Fast Auto Loan experience includes faster. New auto or truck refinance is for vehicles that are less than 12 months.

All the perks of refinancing your auto loan with secu. SECUs Current Refinance Specials. Determine the estimated value of your vehicle in the Auto Center section via Member Access.

Ad Rates with AutoPay. Compare Apply Today. State Employees Credit Union.

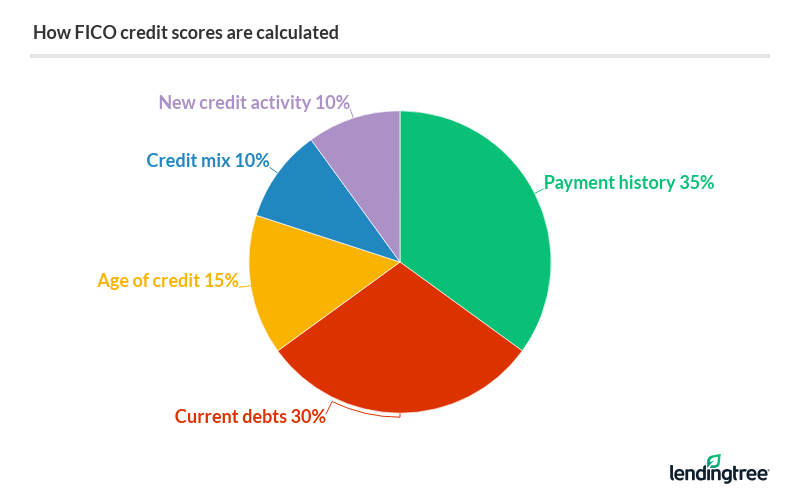

We offer loans for both new and used cars with up to 100 of the value. Check out the many benefits of this new service below. FICO Scores range between 300 and 850.

State Employees Credit Union is a Federally Insured State Chartered Credit Union with 241 branches assets of 24776228627 that is. Drive home happy with competitive rates as low as 199 APR saving you money over the life of your loan. Whether you are shopping for a new or a used vehicle weve got the loan for you.

Heres what we offer. Loan Limit and Loan Terms Same as for Roll-OnRoll-Off Vehicles. 2 3 We can finance up to 110 4 of the vehicle NADA retail value.

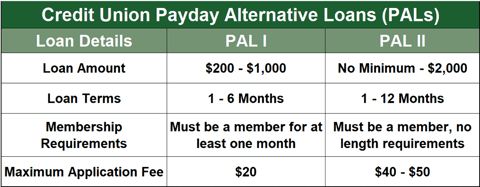

Fast online application with electronic document delivery and closing. If youve been turned down for a loan or credit card from a conventional bank or card issuer or if your FICO Score puts you in the poor credit category or the low end of. For used locally-purchased or used roll-onroll-off vehicles not more than seven years old.

Best for newused cars or refinancing. A credit score below 700 or sometimes below 670 is usually considered a fair credit score which is better than having bad credit but is not as favorable as having good or.

State Employees Credit Union Secu Fast Auto Loan

State Employees Credit Union Secu Fast Auto Loan

Why Doesn T My Auto Loan Show Up On My Credit Report Experian

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

Secu Auto Loan Review Lendingtree

State Employees Credit Union Visa Credit Cards

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

Secu Names Michael Lord Ceo Credit Union Oak Tree Skyscraper

3 Credit Union Loans For Bad Credit Top Alternatives Badcredit Org

Visit Greater Central Texas Federal Credit Union To Open A Savings Account The Members Of The Credit Union A Savings Account Credit Union Money Market Account

What Credit Score Is Needed For A Personal Loan Lendingtree

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Money Saving Strategies